Investment Basics

Is your child a toddler, "tween," or teenager? Do you believe in taking some risk or are you a conservative investor? Are you hands-on or do you prefer to keep it simple?

Don't worry - investing doesn't have to be complicated. Indiana529 Direct offers a range of investment options that will match your needs, no matter your comfort level.

What am I investing in?

No matter your risk tolerance, remember that 529 plans structure and limit the investment options so you don't get hung up by not knowing what to select. When you invest in a 529 plan you are purchasing municipal fund securities, the value of which will vary with market conditions.

What is a portfolio?

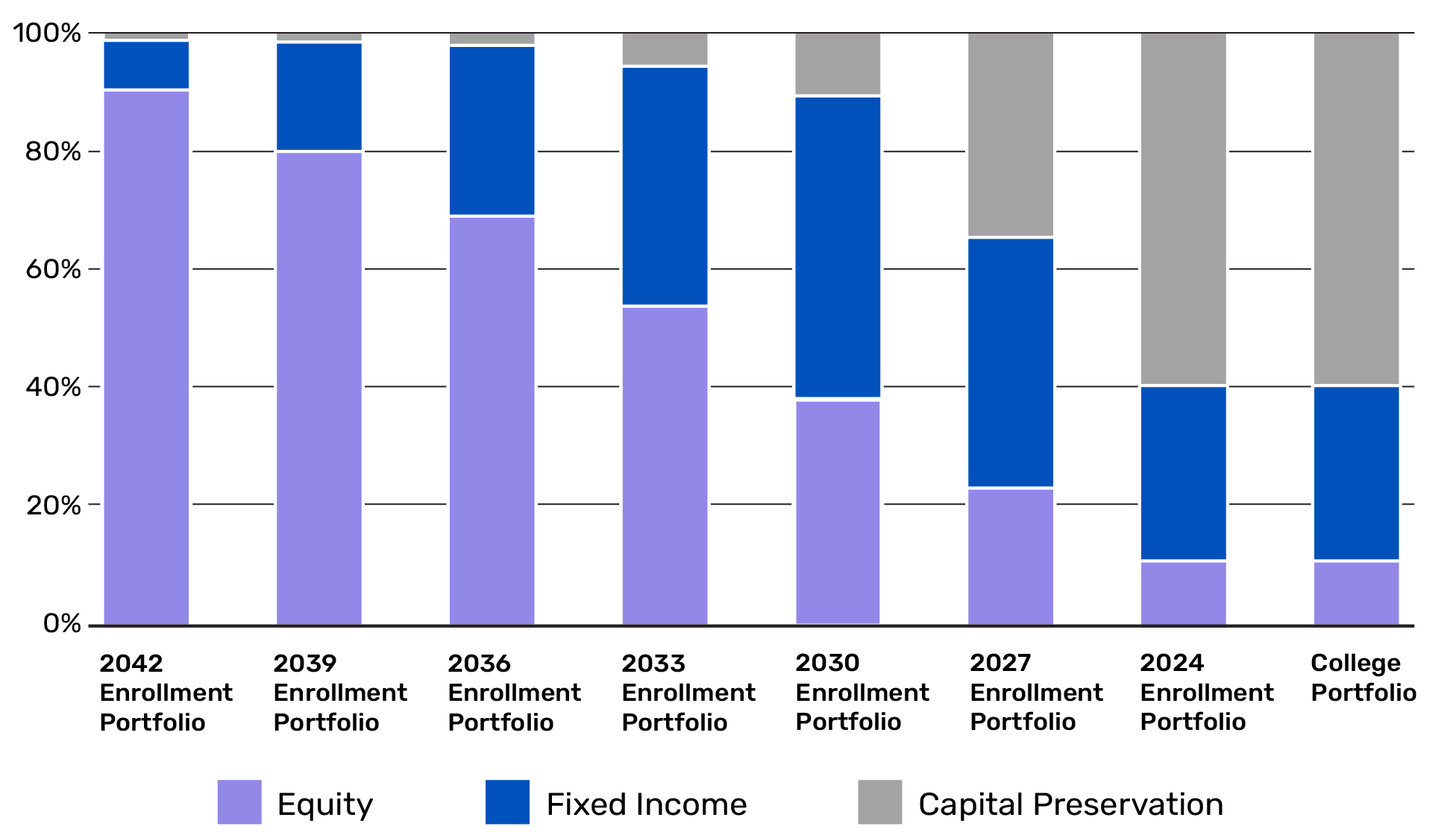

A portfolio in Indiana529 Direct is also called an Investment Option. It’s generally comprised of underlying investments that could be stocks, bonds, and capital preservation options.

How do I know which portfolio is right for me?

Some portfolios automatically adjust as your beneficiary nears enrollment age, while other portfolios are designed for those who want to pick and choose individual options themselves. Your portfolio selection is completely up to you and your investing comfort level.

Investment options

Choose by Enrollment Year or Pick Your Own.

Choose the investment option that best aligns with your goals.

FAQS

Learn More About Investing

Yes! You can change the direction of your future contributions at any time. Federal law permits you to move the existing assets in your Indiana529 Direct account to a different mix of investment options twice per calendar year.

No. Indiana529 Direct is not insured or guaranteed, with the exception of the Savings Portfolio, which is insured by the FDIC. Investment returns will vary depending upon the performance of the Portfolios you choose. Depending on market conditions, you could lose all or a portion of your investment.